Get the free deposit receipt template

Get, Create, Make and Sign receipt deposit printable form

How to edit receipt for deposit online

How to fill out deposit receipt form

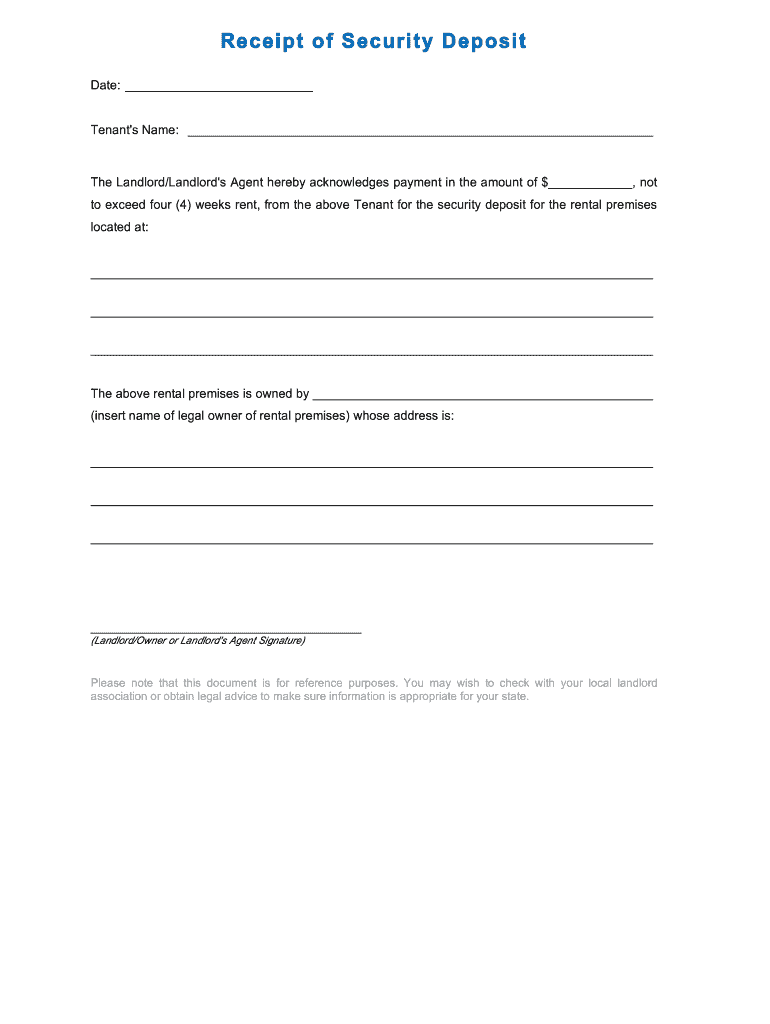

How to fill out Receipt of Security Deposit

Who needs Receipt of Security Deposit?

Video instructions and help with filling out and completing deposit receipt template

Instructions and Help about receipt for deposit template

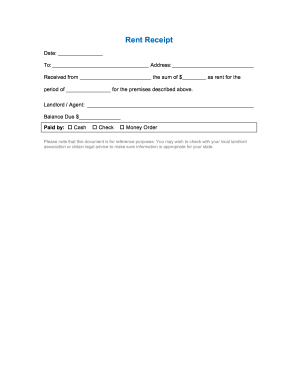

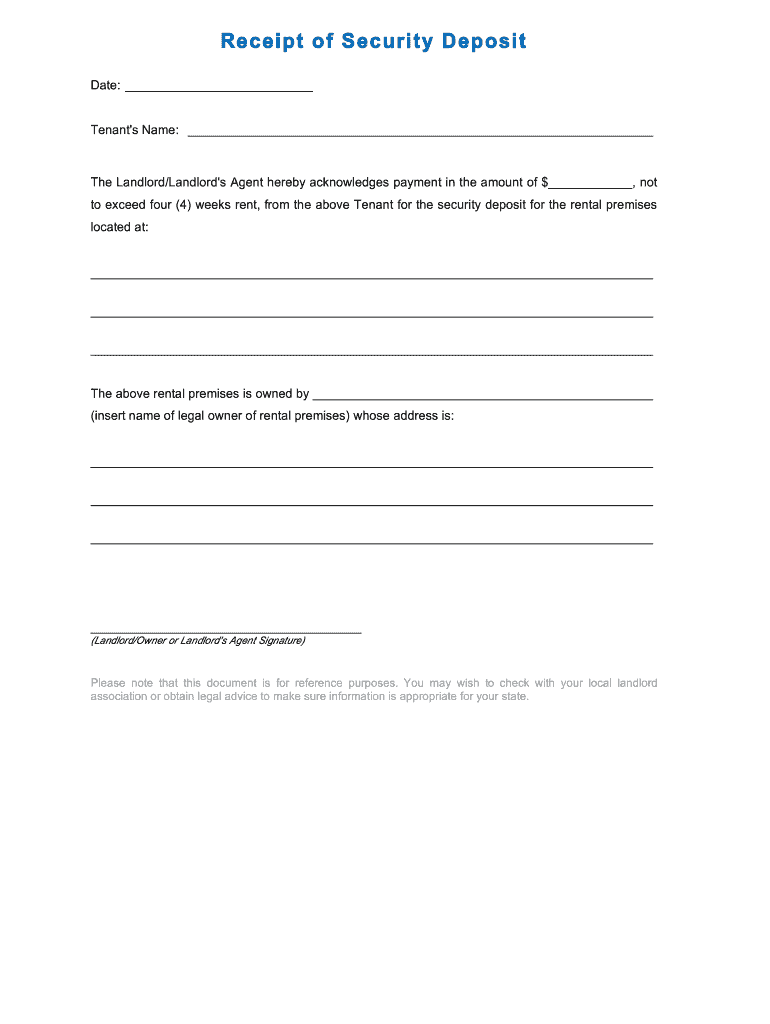

Hi if you're looking to download and write a security deposit receipt all you have to do is come right to this webpage, and you can download it in either Adobe PDF Microsoft Word or rich text format so what we're going to do is do it in Adobe PDF because that seems to be the easiest for everyone, so I have to do is just as a fillable format so all you have to do is just enter the date in the upper right-hand side, so we'll just write today's date which is May 24th 2015 now the address you just enter the landlord's address here tenants address we will say it's 1 2 3 apples the lane, and then you can go through all the way here you enter the name description of lease so what you want to write here is the date the lease was signed along with the if it's an apartment right the apartment number along with all the details of the lease agreement the Landlord acknowledges the receipt of this is where the security deposit amount will be entered signature by landlord name a landlord all you have to do is print, and you have a security deposit receipt finalized and at your disposal thank you very much

People Also Ask about receipt security deposit pdf

What is the purpose of bank deposit documentation?

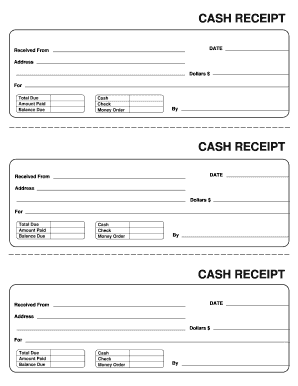

What is a deposit receipt form?

How do I write a receipt for a deposit?

What is a deposit document?

What is security deposit receipt?

What is the meaning of deposit document?

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit security deposit receipt from Google Drive?

Can I sign the receipt deposit security template electronically in Chrome?

How can I edit rent deposit receipt on a smartphone?

What is Receipt of Security Deposit?

Who is required to file Receipt of Security Deposit?

How to fill out Receipt of Security Deposit?

What is the purpose of Receipt of Security Deposit?

What information must be reported on Receipt of Security Deposit?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.